us germany tax treaty social security

Germany and the United States have been engaged in treaty relations for many years. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits.

Taxes In Germany Vs Us Full Comparison 2022

In the year 2040 the percentage will be 100.

. Tax purposes as if they were paid under. The Germany-US double taxation. 3 Relief From Double Taxation.

9 Golding Golding. If their assignment is more than 5 years they pay into the German system of social security. In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding.

8 Exchange of Information. The treaty has been updated and revised with the most recent version being 2006. For questions please contact please enclose the letter you received on your pension a passport copy and your green card Finanzamt Neubrandenburg.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. About Our International Tax Law Firm. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries.

If a person is assigned to work within Germany for 5 years or fewer by a United States company they will pay taxes into the United States Social Security system. The complete texts of the following tax treaty documents are available in Adobe PDF format. It was effective for benefits paid after December 31 1990 for areas which were formerly in.

Ad File your German tax return in just 17 minutes. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

2 Saving Clause and Exceptions. A receives in the year 2018 his. Expat Benefits in Germany.

Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979. The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US. The purpose of the Germany-USA double taxation treaty.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. This percentage increases up to 2020 by 2 per year and from then on by 1. US-German Social Security Agreement.

It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system. In the Federal Republic of Germany this will include. 1 US-Germany Tax Treaty Explained.

01149 395 44222 47000. Completely online in English - no more tax forms. Germany - Tax Treaty Documents.

The Convention further provides both States with the flexibility to deal with hybrid financial instruments that have both debt and equity features. The exemption was effective for benefits paid after December 31 1989 for areas which were formerly in West Germany. Residents are regarded for US.

Easy German tax returns for expats. If an expat held a direct or indirect interest of 1 or more in a domestic or foreign corporation within the last five years 60 of the capital gain from the subsequent sale of shares is taxable. This US-Germany tax treaty helps US expats avoid double taxation while living in Germany.

In the year 2005 only 50 of the payment was subject to German income tax. Secure your tax refund now. If an expat held less than 1 the entire capital.

Germany taxes capital gains with the rate depending on the nature of the gain. 4 Income From Real Property. A person whose employer is non-US will pay their taxes to Germany.

All groups and messages. As amended by a Supplementary Agreement signed at Washington October 2 1986 entered into force March 1 1988 and by a. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries.

As amended by a Supplementary Agreement signed at Washington October 2 1986 entered into force March 1 1988 and by a Second Supplementary Agreement signed at Bonn March 6 1995 entered into force.

Germany S Carbon Pricing System For Transport And Buildings Clean Energy Wire

Should The United States Terminate Its Tax Treaty With Russia

The World S Refugee Crisis Past And Present Refugee Crisis Refugee Forced Migration

Taxes In Germany Vs Us Full Comparison 2022

Map Of Europe 1000 Bce History Of Early Medieval Europe Timemaps

Social Security Implications For Global Assignments Mercer

What Is The U S Germany Income Tax Treaty Becker International Law

Us Expat Taxes For Americans Living In Germany Bright Tax

Printable Alberta Shaped Writing Templates Writing Templates Writing Paper Template Lined Writing Paper

Us Expat Taxes For Americans Living In Germany Bright Tax

Colin Gordon Income Share Of The Top 1 Percent 1913 2012 Annotated Annotation Percents Stock Market

Social Security Taxes Expatrio Com

Social Security Totalization Agreements

Mapping China S Biggest Trading Partners Is Your Country One Of Them

Doing Business In The United States Federal Tax Issues Pwc

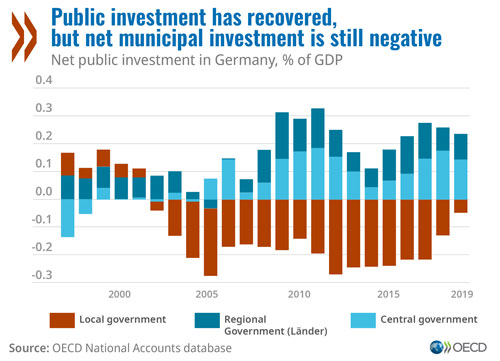

Germany Invest More In Infrastructure Digital Economy And Energy Transition For A Strong And Greener Recovery From Covid 19 Crisis Oecd